The EU is at renewable fuel crossroads - six urgent priorities

Today we try to make sense of what the EU needs to do to give renewable fuels and feedstock a fair chance.

Renewable fuel and feedstock developers inside and outside of the EU are ready to take large scale projects forward. Unlike carbon capture and storage-based projects, the technology is proven and readily available. The cost of renewable electricity continues to fall. Getting the numbers to work depends on lowering the cost of capital and ensuring regulatory certainly, especially on carbon pricing, demand side mandates and clear rules on eligibility for incentives for early mover projects.

The EU’s climate policies are complex. It can be hard to put the wrangling over some regulatory details in a context and assess its importance. Here are six important priorities for the EU to turn its Clean Industrial Deal into a reality for renewable fuels and feedstocks.

Cover image of Corporate Europe Observatory’s publication “EU Clean Industrial Deal in Action: Opening Floodgates to Dirty Hydrogen from Fossil Fuels” (March 2025).

1. Follow through with renewable targets – make sure governments stick to RED III

Investors planning a large project with a 20 or 25 year lifespan need clarity and certainty. This should have been delivered through the national transposition of the Renewable Energy Directive (RED III), which requires EU member states to set out how they will achieve the mandatory targets that renewable energy use should be at least 42.5% in 2030. Only a small handful of the member states have fully or partially implemented these targets. “This puts the green hydrogen industry in a bind. The RED III mandates were billed as the game-changer that was going to force H2 users in industry and transport to buy up green hydrogen in vast quantities by 2030. But until these rules are transposed into national law, they are to all intents and purposes unenforceable — leaving producers in many countries without any customers for the foreseeable future.” (Hydrogen Insight 12 June.)

2. Define low carbon hydrogen - adopt the draft Delegated Act on Low Carbon Hydrogen

The European Commission must be rigorous when labelling hydrogen made from fossil fuels as low carbon. There continues to be a strong push to brand hydrogen with dubious climate credentials as "low carbon". As long as this persists, renewable hydrogen will be either directly undercut or quietly compromised due to regulatory uncertainty.

One more time: Low carbon blue hydrogen projects that meet the emissions reduction requirements of key markets such as the European Union, Japan or Korea do not currently exist. They are a risky bet on an expensive technology that consistently fails to meet expectations. Autothermal reforming has not yet been done at scale, methane leakage is unacceptably high in most countries producing oil and gas, and we don’t know enough about permanent carbon storage, both technically and financially.

Bottom line: we don’t have any reliable real-world prices for genuinely low carbon fossil hydrogen. Anyone who argues that blue hydrogen will be cheaper than green should not be allowed to get away with this without clarifying what kind of blue and what kind of assumptions are being made. There is a lazy acceptance that high quality blue is already available at competitive prices. This is wrong and it is undermining genuinely sustainable green projects. And remember, creating uncertainty is sufficient to undermine the confidence required for investors to take large risks.

3. Charge carbon emissions

Putting a levy on carbon emissions is fundamentally the easiest way to give renewable and genuinely low carbon fuels and feedstocks a fair chance against current fossil fuels. The EU should continue to lead the global charge for carbon pricing. Because of the free allowances inside the EU, we will not start to have proper levies until these allowances are phased out, starting in 2026.

Martin Tengler, Head of Hydrogen Research at Bloomberg NEF, at the above mentioned seminar concluded: “We need proper carbon pricing, which right now in the EU doesn’t really exist: there is a carbon price but the same companies that would actually have the highest incentive to use green or bluer any other version of clean hydrogen (like ammonia producers) don’t actually have to pay it, because they get free allowances.”

4. Incentivise renewables - allocate further resources including through the EU Innovation Fund and the European Hydrogen Bank

“EUR 111 bn in annual subsidies to fossil fuels, with EUR 20 bn altogether having gone to hydrogen” said our colleague Daniel Fraile from Hydrogen Europe 12 June at a great seminar hosted by Hydrogen Insights. We agree with Daniel that this is counterproductive and unsustainable.

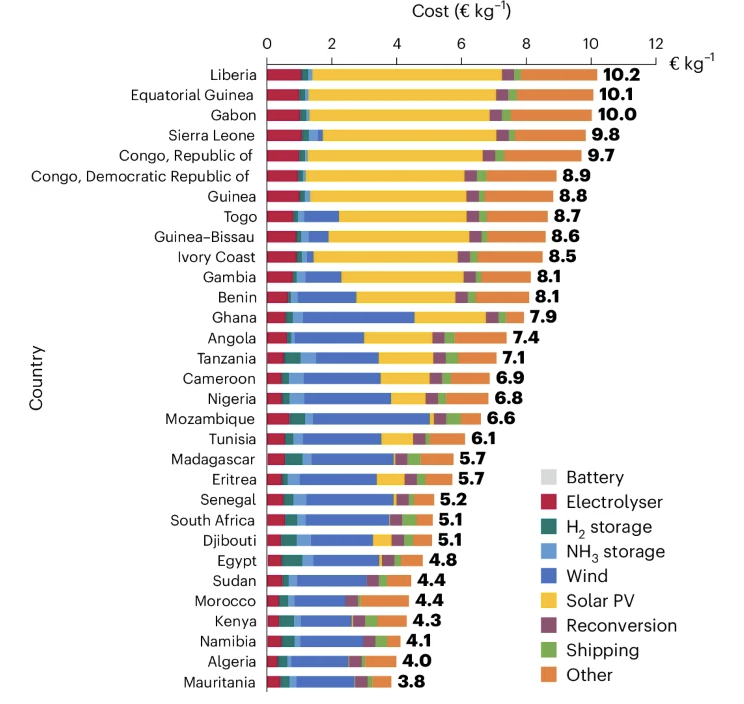

With renewable electricity costs continuing to fall, reducing the cost of capital is a high priority, especially for projects in developing and emerging markets that will account for the majority of future emissions. In a recent paper published in Nature Energy and reported by Hydrogen Insight, “Across the board, the cost of capital for green hydrogen projects in Africa is expected to be high, averaging 15.5% in a high-interest

As I said yesterday: “For many emerging markets, you need OECD governments to step in and lower capital costs with state guarantees and other instruments”. The European Commission should work together with not least Germany and the Netherlands in a task force brining coordination and focus to climate finance, guarantees and other efforts to lower the costs of capital in Africa and beyond for European developers. While the European Hydrogen Bank is a promising start, both a national and EU level, more needs to be done to bring down these costs.

5. Permitting and approvals

The EU has long acknowledged that permitting and approvals remains a bottleneck, particularly for large scale renewable energy projects. Through designations that recognise their strategic importance, such as Projects of Common European Interest (PCI) or Important Projects of Common European Interest (IPCEI); some technologies have received fast-tracked treatment. But so far, renewable fuels and feedstocks have been largely left out. These projects do not need more innovation, they need timely approvals, clarity on eligibility, and access to the same permitting pathways already in place for batteries and grids.

Fast-tracking is not just about permitting. Projects needs political backing and our fellow citizens needs to brought along. Under the heading “Wind turbine NIMBYism takes a U-turn in face of savings” Octopus Energy reported a survey revealing that nine in ten people support having a wind turbine in their postcode area if it means half price electricity. In Sweden, there is growing use of windmoney or windbonus, sometimes approximately EUR 1000 per turbine to local communities, which appears to build a growing recognition for that it may be in everyone’s interest with renewable energy infrastructure.

6. Step up energy and climate diplomacy

EU President Ursula von der Leyen, Executive Vice President Teresa Ribera and Commissioner Dan Jorgensen are tirelessly engaging in energy and climate diplomacy, in spearheading visits to countries such as India and those in North Africa to forge partnerships and enable trade of renewable energy. These efforts must to a greater extent be followed up and implemented. There is often a need for capacity support, collaboration with other development partners and a constant focus on often quite technical or detailed work to remove bottle necks and barriers to quick progress.

Jonas Moberg,

CEO, GH2